|

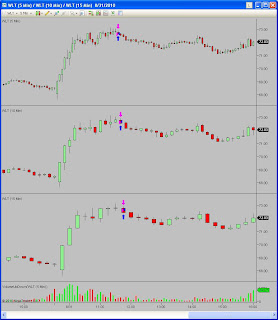

| stayed strong, doubled up. the real exit was on the start of the 130 15min bar. i was just trying to hang in there to see what could happen. |

|

| i am not a fan of big gap down days. they tend to be inside days and its hard for me to make money. the conflict is, yesterday, i thought the same thing but there were some decent movers if you found them. today, i didn't have quite the same luck. even at the end of day review i didn't see much that i liked. |

|

| monster up move. nice red doji. candle prior was top wickish. got stopped out. went after it again a little later on, doubled up and exited because of signals on the 5 and 10. |

|

| its a short, short, stopped out of second half on first blue arrow, stopped out of original half on second blue arrow. the 1245 trade was a long after the market broke highs of the days and retraced. i thought it was taking a breather to go higher. i was incorrect. entry based on 5 minute. the 15 would not have gotten me in because it never broker highs of the real body or highs of the wick. looks like i gave up later in the day. actually, i think i took a nap i was so frustrated with the morning. looking back, i don't see the reason for all the frustration, it doesn't seem like anything was that hard today. |

|

| i'm always amazed at the action around these levels that i draw as the chart unfolds. the lighter blue was a line i thought about putting in, but didn't until end of day review. that doji on the 5 around 330 was a great signal. that and the hammer around 10 am were the two best signals of the day. |

very frustrating morning for me but looking back now, it doesn't seem like it was that bad. i think the problem is i look to see how much i am down and that drives me nuts. i am using stops that are way too large or using too much share size. the most i want to risk per trade is $40 yet i find myself risking .40 on 200 shares. i need to get back to where i am comfortable and trade properly.

i need to crank the tunes so the day passes me by. i remember when i first started trading the days would fly by. now, they seem to go on forever because i am just so frustrated that i can't get it right. yes, i can get a few good trades in here or there, but they never seem to get over the hurdle of my losers. i used to think i could have a 40% win rate, and 2.5R on my winners and i would be set. but,in reality it isn't working that way. the math works that way so i don't know what i am doing wrong. maybe the problem is with R. for some trades R is .15 so a winner of .38 is good. but other trades risk .40, so i would need to take a $1 on the next one to stay ahead of the game......

actually, i think i just figured out the problem.(update: i think the R thing actually works after doing the math) R is based on a set number you are willing to risk, for me, lets say $30 per trade. you take the $30 and divide it by the stop, in this instance .15. So I can trade 200 shares. if i get stopped out i lose $30, if i exit at a 2.5R gain i get $38. next trade, my risk is .30, so i only trade 100 shares. if i get stop, my risk is still $30. if i am right, i gain $75 (2.5*.30). i know my probability of winning trades is 40%. on an average of 10 trades, if i have six losing trades at $30 loss per trade, that is -$180. if my four winners come from .15 risk trades of 200 shares a piece, and i exit at 2.5R, then i am up $300 (.15*2.5*200*4).mmmm, maybe it does work. i am going to try it with ninja trader tomorrow. the problem with lightspeed is i can't enter orders that are odd lots. and i love lightspeed. lets see how the proper position sizing helps my trading tomorrow and we will go from there.

i know you can do odd lots at interactive brokers and trade station but there trades cost more than lightspeed. plus, interactive brokers interface stinks. i don't know if i want to pay for Ninja Trader and trade station seems pretty close to lightspeed interface, but they don't let you demo the software. oh, and i need my lightspeed ticker.

phew long rambling post. sorry

working on my win rate will solve all these problems.

|

| i was waiting for this one to setup short. i was a bit early. i could see go long shortly after and possibly either getting out around 145 or going for a big drop down real fast and getting stopped. i am seeing now the decent narrow bar that occurred after the top wickish candle. excellent short signal. i think this game is all about patience in waiting for the correct setup to unfold, and patience in waiting for a proper exit signal. |